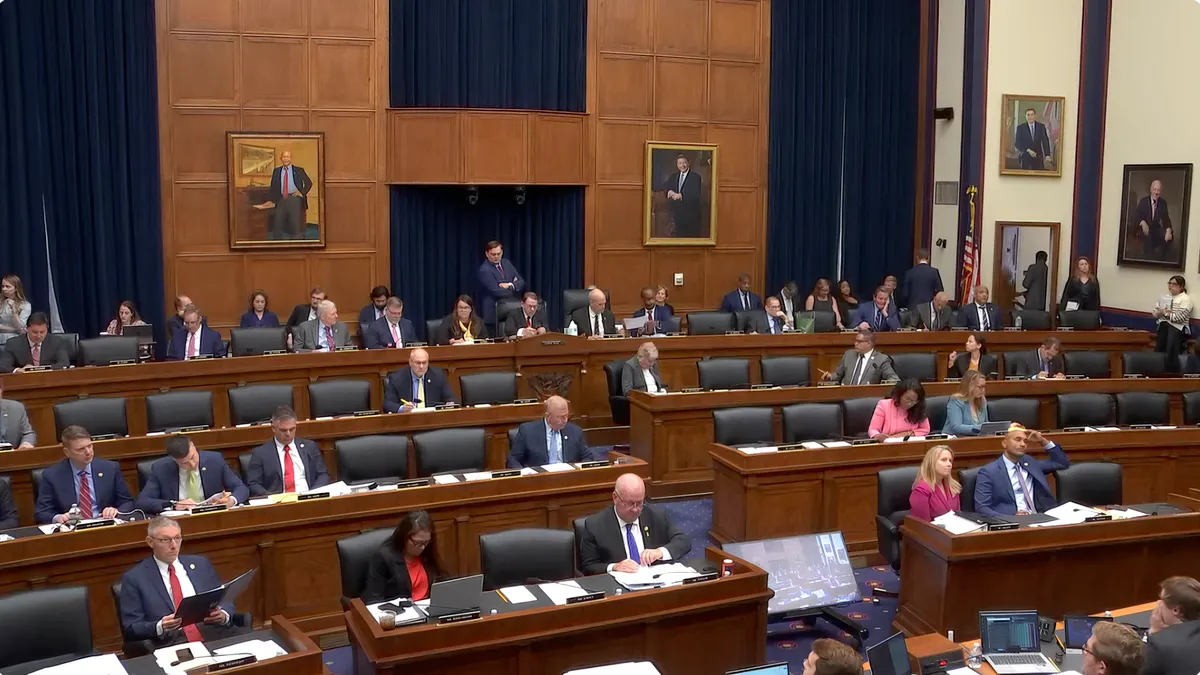

UPDATE: MAY 1, 2025: The House Committee on Transportation and Infrastructure approved its portion of the budget reconciliation bill yesterday on a party-line vote of 36-30.

Democrats put forward some 120 amendments to the committee’s bill, Rep. Rick Larsen, D-Wash., said during the meeting, none of which were adopted. Proposed amendments included protecting grants to Amtrak’s Northeast Corridor issued before Jan. 20, 2025. Larsen lamented the lack of bipartisanship in an emailed statement: “Today’s markup of the Republican reconciliation legislation is a departure from the regular, bipartisan work of this Committee.”

Support for the bill came from road builders, the U.S. Chamber of Commerce, agricultural interests and truckers. The Amalgamated Transit Union expressed its support in an April 29 letter, saying “the federal gas tax is no longer capable of sustaining the [Highway Trust Fund] on its own.” In addition to roadway infrastructure, the fund also supports mass transit.

“Congress must find a long-term solution to declining real gas tax revenue,” Albert Gore, executive director of the Zero Emissions Transportation Association, said in an April 28 letter to the committee and shared with Smart Cities Dive. The organization favors a $100 per vehicle yearly fee over the $250 annual federal registration fee the committee adopted. Gore said the lower fee would be “commensurate with the annual gas tax paid by an internal combustion engine vehicle with average fuel efficiency.”

More legislation affecting electrical vehicle adoption may be included in the reconciliation package. The full House voted yesterday to overturn the Biden administration’s approval of California’s clean truck rules and is expected to vote today to nix California’s Advanced Clean Cars II regulations requiring all new passenger vehicles sold in the state to be zero emission vehicles by 2035.

APRIL 29, 2025: The House Committee on Transportation & Infrastructure included a $250 annual registration fee for electric vehicles and a $100 annual registration fee for hybrid vehicles during the budget reconciliation proposal reported out today.

The proposal’s goal is to ensure that EV and hybrid owners contribute to the Highway Trust Fund. An excise tax on gasoline and diesel fuels, along with a sales and use tax on heavy duty vehicles, currently support the fund, which committee Chairman Sam Graves called “broken” in a press release Tuesday.

“For far too long, EVs have operated on our nation's roads without paying into the system,” Graves said at the committee meeting. “Plain and simple, this is a fairness issue, and it's time these roadway users pay their share for the use of the road.”

The current federal gasoline tax, at 18.4 cents per gallon, hasn’t changed since 1993. If it were indexed to inflation, the current rate would be 37 cents per gallon, according to the Urban Institute and Brookings Institution’s Tax Policy Center. As a result of the static tax rate, inflows to the trust fund haven't kept up with expenditures. Since 2008, Congress has made up the shortfall by transferring funds, mainly from the federal government’s general fund, to the tune of $275 billion, including $118 billion from the 2021 infrastructure law.

Outlays from the trust fund go to states and local governments for the maintenance and construction of highways, bridges and related infrastructure. A portion of the fund’s investments go to mass transit.

In the 2024 fiscal year, the Highway Trust Fund spent $26.7 billion more than it took in from user fees, according to analysis by the Eno Center for Transportation. The Congressional Budget Office projects the fund will have insufficient funds to cover its expenditures by 2028 if funding increases at the rate of inflation and the tax rate remains the same. By 2035, the CBO projects the trust fund will be short $242 billion.

Democratic committee members uniformly denounced the budget proposal, which they say favors the wealthy while cutting programs for other citizens. “This bill would raise new taxes on the American people in order to provide trillions of dollars in tax breaks for billionaires,” Rep. Salud Carbajal, D-Calif., said at the meeting.

The House committee bill would cut $4.6 billion over the next 10 years by rescinding funds for Inflation Reduction Act programs that the press release called unnecessary, which include Neighborhood Access and Equity Grants, Environmental Review Implementation Funds and Low-Carbon Transportation Materials Grants under the Federal Highway Administration; Assistance for Federal Buildings and Use of Low-Carbon Materials, and Emerging Technologies funding under the General Services Administration; and the Federal Aviation Administration’s Alternative Fuel and Low-Emission Aviation Technology Program.

“Today's legislation is, in part, a response to investments that Democrats prioritize, some of which are objectionable to our [Republican] colleagues,” Rep. Rick Larsen, D-Wash., said. “We want to keep these investments going.” Larsen said he and other Democrats would introduce amendments to the budget proposal.