Dive Brief:

- A New York City pilot program will provide low-interest loans and technical assistance to help aging affordable housing cooperatives straighten out their finances and complete maintenance work.

- The two-year program will help 20 to 30 co-op buildings — impacting as many as 600 low-to-moderate income housing units — using $750,000 in funds. The technical assistance will help homeowners pay down debt, settle government arrears and renovate vacant units, among other things.

- Co-ops are one of the few avenues for homeownership that low-income people have in New York City, said Margy Brown, executive director of the nonprofit Urban Homesteading Assistance Board. Maintaining them will allow those residents, their children and future generations to have access to stable housing and continue building wealth, she said.

Dive Insight:

Preserving existing affordable housing is part of the large puzzle that is solving the nation’s affordable housing crisis, said Joseph Schilling, a senior research associate at the Urban Institute. The New York pilot program is one of several methods U.S. cities have tried to provide resources and technical assistance to property owners and landlords so they can complete the repairs needed to get their units safe and up to code.

Detroit, for instance, created a fund in 2020 that uses private funding to help preserve and develop affordable housing. In Cook County, Illinois, a housing preservation compact — a consortium of government agencies, organizations and initiatives — helps preserve affordable rental units through various strategies such as providing property tax incentives.

And a 2017 program in Pittsburgh provides loans to people looking to acquire, renovate or operate existing affordable rental units in the city. A bipartisan group of lawmakers in Pennsylvania is also pushing legislation that would create a new statewide housing repair program.

Maintaining aging housing stocks that are typically considered affordable for working individuals and families can be challenging for private-sector landlords in large cities with old homes like New York City, Chicago and San Francisco, said Schilling.

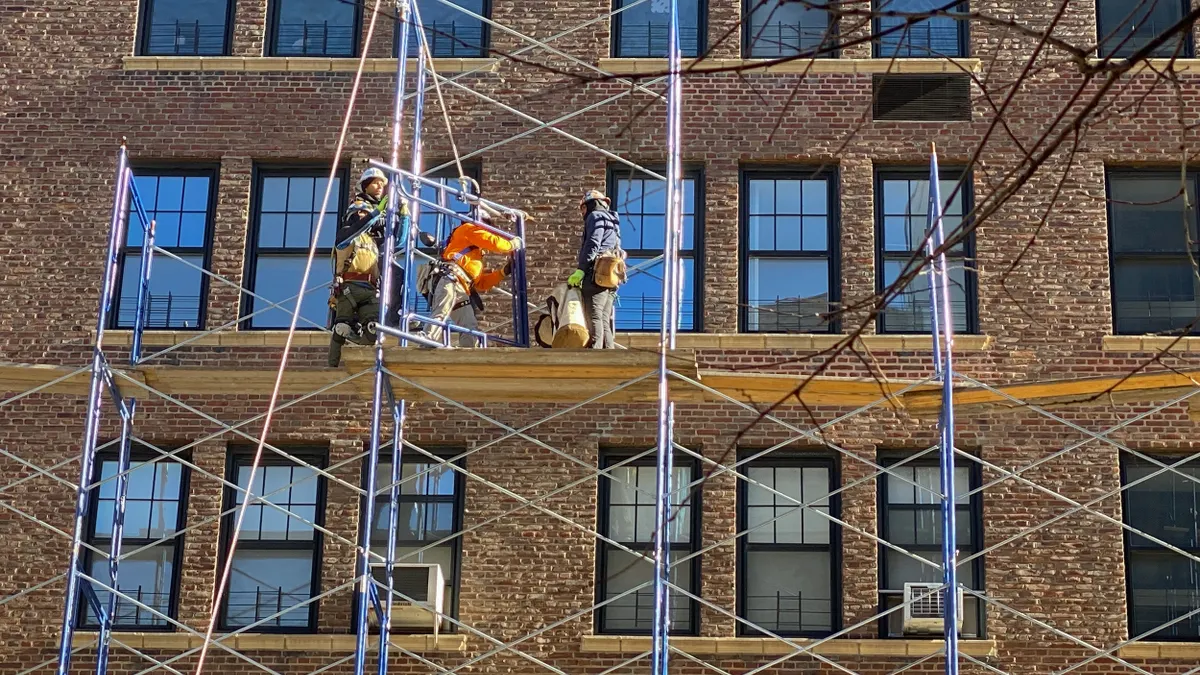

Older buildings require HVAC and heating system maintenance, bug and pest extermination, and roof, plumbing and structural repairs, Schilling said. Getting them up to code and to acceptable conditions often requires resources, DIY solutions and the use of property management firms, he said.

New York City acquired many financially distressed and abandoned residential buildings in the 1970s and 1980s, some of which were turned over to the building’s tenants through a co-ownership structure known as Housing Development Fund Corporation. Through the HDFC co-op arrangements, tenants owned their apartments and became shareholders of their cooperatives.

The city has more than 1,000 HDFC co-ops in its portfolio, and it found in a recent review that “a high number” of the buildings “are at high risk and could benefit from assistance.”

The co-ops are important sources of homeownership for people with low or moderate incomes — but many are in need of help, said Brown of UHAB, which will provide technical assistance to co-ops through the pilot program.

The pilot program, launched by the city and the New York Attorney General, will span two years at a cost of $750,000, said Brown. It’s using funds from billions the New York attorney general received through settlement agreements with companies like JPMorgan Chase that played a role in the 2008 mortgage crisis.

The program will help owners of older units, in particular, improve their financial position and get technical assistance towards making repairs, navigate outstanding bills owed to city agencies and renovate their space so they can be turned over — generating more cash flow to the co-op, said Brown.

It will also help cooperatives hold regular elections so they can get back in good-standing and offer them flexible low-interest loans so they can stabilize their finances and get out of debt, she said.

“We’re really looking for buildings that have one of these hurdles to overcome that will help to increase their operations on an ongoing basis,” said Brown. UHAB will “provide this deeper dive technical assistance and really shepherd them through the process of resolving it.”